- Weekly Mortgage Update

- Posts

- Rate Cut Announced, Yet Mortgage Rates Edge Higher—What’s Going On?

Rate Cut Announced, Yet Mortgage Rates Edge Higher—What’s Going On?

Weekly Mortgage Market Update

Hello everyone! Can you believe it’s already November? The days are shorter, holiday talk is in the air — and a lot of people in our industry start taking their foot off the gas.

That’s your advantage.

Use the next 60 days to show clients you're still in the game. Stay visible. Stay available. When others slow down, your hustle will stand out and that extra effort now can set you up for a strong finish to 2025!

Read time: ~4 minutes

Rates ended HIGHER compared to last week, and volatility was HIGH. Rates are in the mid 6’s for most loan types without paying discount points. Paying discount points can get you in the low 6’s to the high 5’s.

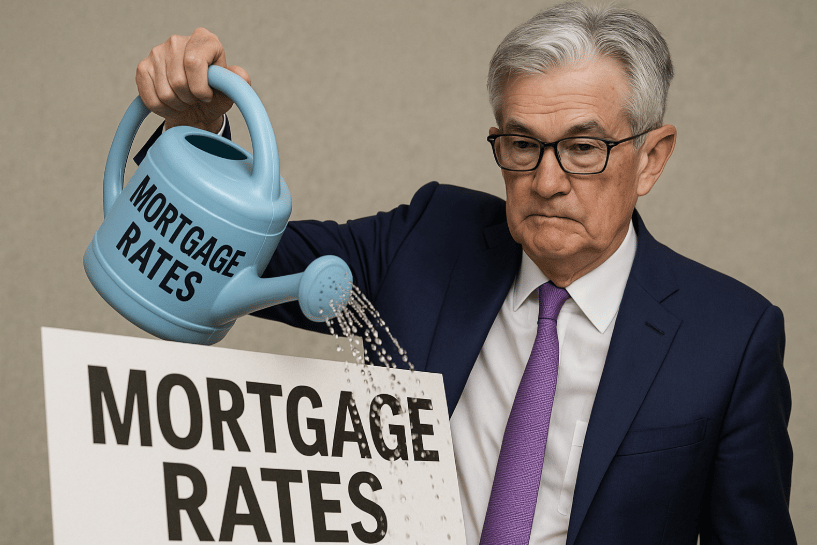

Rate Cut Announced, Yet Mortgage Rates Edge Higher—What’s Going On?

The Federal Reserve delivered a 0.25% cut to the Fed Funds Rate this week, but mortgage rates didn’t follow suit. In fact, they moved slightly higher.

This counterintuitive reaction stems from two sources: Powell’s cautious outlook and changes to the Fed’s balance sheet strategy.

During his press briefing, Chair Powell made it clear that future rate cuts are not guaranteed. His message was that the Fed is watching incoming economic data closely and will only cut again in December if it sees meaningful progress toward its inflation mandate. That uncertainty prompted traders to revise their expectations—and mortgage rates adjusted accordingly.

The Fed also announced it will stop Quantitative Tightening (QT) on December 1st. QT is the opposite of quantitative easing; it reduces the Fed's balance sheet by allowing maturing bonds to roll off without reinvestment. Until now, QT has included both Treasuries and mortgage-backed securities (MBS).

Starting in December, the Fed will reinvest proceeds only into Treasuries- not back into the MBS market. Without the Fed as a steady buyer of mortgage-backed securities, the supply of MBS must be absorbed by private investors who may demand higher yields to compensate for additional risk, ultimately contributing to upward pressure on mortgage rates.

Bottom Line: While the Fed’s rate cut affects short-term borrowing costs, mortgage rates are more closely tied to long-term bond yields and MBS demand. Without further signs of economic weakness or cooling inflation, rates could remain steady or increase in the near term.

Jobs Report Delayed… But Signs of a Weakening Labor Market Keep Building

Normally, this is the week we’d all be glued to the newest jobs report which is one of the biggest indicators for mortgage rate direction. But thanks to the ongoing government shutdown, that data is now on ice.

With no fresh labor stats for nearly two months, investors and analysts are doing their best detective work, tracking private sector trends and corporate announcements instead. And what they’re seeing isn’t exactly reassuring.

Over the past few weeks, companies like UPS, Amazon, and Intel have made headlines with significant layoffs. Whether it’s the result of slower spending, cost-cutting, or early signs of AI disruption, the message is the same: the labor market might finally be softening.

If this continues, the next official employment data could show negative job growth - and once unemployment starts climbing, history tells us it usually accelerates, not drifts.

Key Takeaway: Even without the official jobs report, warning signs are piling up. If unemployment starts ticking higher once data is released, it could be the catalyst that finally pushes mortgage rates lower.

Another Chart… Another Reminder the Housing Market Is Stuck 🧊

In case we needed one more visual reminder of how frozen this housing market is…

Redfin just released a stunning stat: only 28 out of every 1,000 U.S. homes — that’s just 2.8% — have sold so far in 2025. That’s the lowest turnover rate in at least 30 years.

To break it down, the rate is calculated by dividing total homes sold in the first nine months of the year by the total number of homes in the country. And the result? We’re basically at a standstill.

Here’s what’s driving the freeze:

Affordability challenges keeping buyers out

Sellers stuck in ultra-low mortgage rates

Uncertainty in the economy and job market

And it’s even worse in places like New York and major California cities, where turnover is as low as 10–16 sales per 1,000 homes. Here in Las Vegas we are close to the average, down just 1 point at 27, which is -11.3% less than last year.

Key Takeaway: Yes, this market is testing everyone’s patience—but it’s also creating a massive opportunity. Those who stay engaged, sharpen their skills, and continue to serve will be the ones who take off when the market rebounds. Stay in the game—the payoff is coming. 🚀