- Weekly Mortgage Update

- Posts

- First the 50-Year Mortgages...Now Assumable & Portable Mortgages: Solution or Problem?

First the 50-Year Mortgages...Now Assumable & Portable Mortgages: Solution or Problem?

Weekly Mortgage Market Update 11.17.2025

There’s a lot happening in the housing world this week. New mortgage ideas like assumable and portable mortgages are back in the spotlight, NAR is calling for a big rebound in home sales in 2026, and after nearly two months of silence, we’ll finally get the missing jobs reports now that the government is back open.

In this week’s breakdown, I unpack what’s real, what’s noise, and what these shifts could mean for buyers, sellers, and the broader market as we move toward the new year.

Read time: ~4 minutes

Rates ended HIGHER compared to last week, and volatility was HIGH. Rates are in the mid 6’s for most loan types without paying discount points. Paying discount points can get you in the high 5’s to low 6’s.

First the 50-Year Mortgages…Now Assumable & Portable Mortgages: Solution or Problem?

The 50-year mortgage definitely sparked a lot of buzz recently, though most of the feedback hasn’t been all that enthusiastic. I highlighted last week that the numbers aren’t exactly compelling, but it’s still good to see people exploring different ideas to help improve affordability.

Right as that debate was heating up, FHFA director Bill Pulte floated two additional ideas- making assumable mortgages and portable mortgages much more widely available as part of the ongoing effort to find solutions.

Before we decide if these ideas actually help anyone, here’s the quick breakdown:

Assumable mortgage: A buyer takes over the seller’s existing loan — same rate, same balance, same terms. If the seller has a 2.75% rate, the buyer gets that 2.75% rate too. Portable mortgage: A homeowner takes their existing mortgage to their next home. Basically unplug it from House A, plug it into House B. Same rate, same structure.

Sounds amazing, right? Well… here’s the reality:

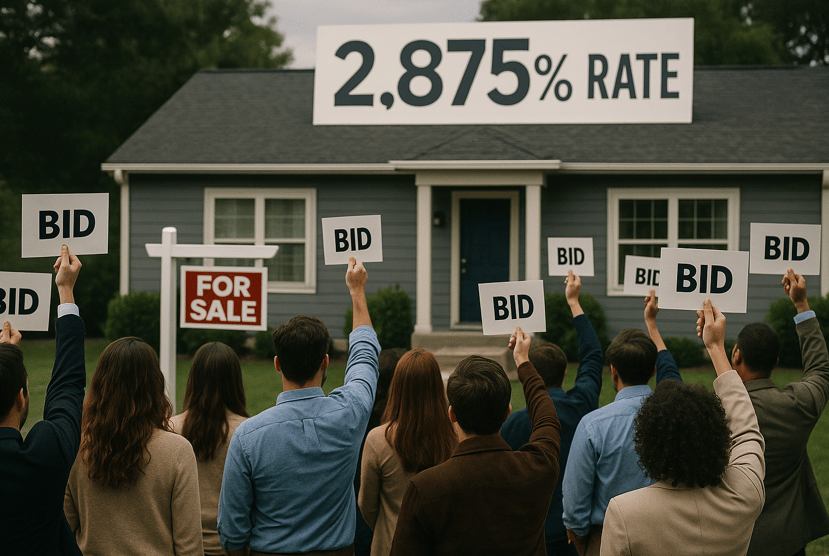

1️⃣ Assumables could actually drive prices UP

Homes with 2%–3% assumable rates would instantly become “premium inventory.” Buyers won’t just be bidding on the home — they’ll be bidding on the rate. That pushes prices even higher and makes affordability worse.

2️⃣ The equity gap kills the dream

You can assume the seller’s rate, but not their equity. If a seller owes $300k on a house worth $450k, someone still has to cover the $150k difference. Most buyers today don’t have that kind of cash.

3️⃣ Portable mortgages don’t help new buyers at all

Portability is great for the person who already has a 2.75% loan. But first-time buyers? This does nothing for them. It actually deepens the divide between those who bought years ago and those trying to buy now.

4️⃣ None of this increases inventory

You can’t fix affordability without building more homes. Assumables and portables are just fancy ways to shuffle around who gets the old low-rate loans.

5️⃣ Low rates don’t make expensive homes cheaper

High home prices, insurance premiums, taxes, HOA fees — none of these magically shrink because someone brings a low-rate mortgage with them.

And let’s not forget the banks. Servicers have zero interest in keeping 2–3% loans on their books. And the logistics required to move mortgages around like luggage at an airport? I feel there is a low chance that they willingly take that on.

Key Takeaway: Everyone is searching for a quick fix to the affordability crisis, but these ideas all ignore the real issue: we don’t have enough homes. Anything that boosts demand without increasing supply only makes housing more expensive — not less.

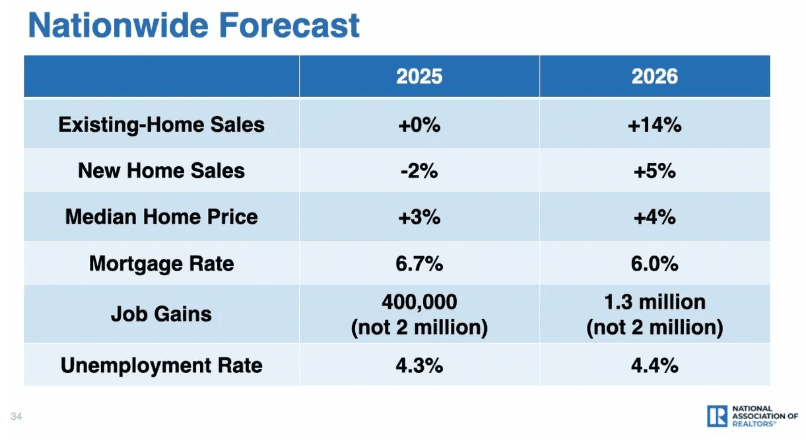

🚀 NAR Says 2026 Could Be a Big Year: +14% Sales Growth

The National Association of Realtors just released its latest forecast, and if they’re right, 2026 could finally bring some real movement back into the market.

Chief economist Lawrence Yun expects home sales to jump about 14%, following what’s shaping up to be a pretty flat 2025. He’s also predicting a 4% bump in home prices.

Why the positive outlook? A few things are finally lining up:

Mortgage applications are surprisingly steady.

The job market is still holding strong (pending those delayed jobs reports… we’ll see).

Builders are slowly adding more inventory.

And rates, while not crashing, are expected to drift down to around 6% on average next year — better than the ~6.7% we’ve been dealing with.

Put all that together, and you’ve got the ingredients for a much more active market!

Key Takeaway: NAR is calling for a 14% jump in home sales in 2026. If you’re in real estate, now’s the time to prep, reconnect, and start planting seeds. Activity is coming — the agents who prepare now will be the ones who benefit the most.

📊 Government Is Back Open…Now Bring On the Jobs Data!

The Labor Department’s September and October jobs reports have been stuck in limbo during the federal shutdown — and it’s left the markets flying completely blind for almost two months.

That ends this Thursday (11/20). We’ll finally get the September jobs numbers plus the first unemployment claims update since mid-September.

Expect some reactions. When the market has been starved for data this long, even small surprises can trigger big moves.

Here’s what we know so far:

August brought only 22,000 new jobs — a very soft reading.

Unemployment sat at 4.3%.

No official forecasts for September or October have been released because analysts haven’t had anything to work with.

For the October report, the Labor Department says it was able to collect enough information from businesses to estimate job growth, but it couldn’t run the household survey — the part that determines the actual unemployment rate. Now that the government is back open, the hope is we’ll finally get an updated, accurate unemployment rate for November… giving us the clarity we’ve been missing for weeks.

Michael Cassano I Loan Officer I NMLS#2024770